NỘI DUNG BÀI VIẾT

อย่าเพิ่งซื้อกองทุน ถ้ายังไม่ได้ดูคลิปนี้ ดูจบ GET เลย!! กองทุน VS Index Fund VS ETFs คืออะไร

นอกจากการดูบทความนี้แล้ว คุณยังสามารถดูข้อมูลที่เป็นประโยชน์อื่นๆ อีกมากมายที่เราให้ไว้ที่นี่: ดูความรู้เพิ่มเติมที่นี่

คลิปนี้จะมาแนะนำสินทรัพย์การลงทุนสุดคลาสสิค นั่นก็คือ กองทุน VS Index Fund VS ETFs

ซึ่งเป็นสินทรัพย์ในการลงทุนที่ได้รับความนิยมไม่น้อยไปกว่าหุ้นเลย และยังเป็นเครื่องมือในการการจายความเสี่ยงและอื่นๆอีกมากมาย แต่จะรู้ได้อย่างไรว่าแบบไหนเหมาะกับเรา มาดูกัน

Remark! คลิปนี้ไม่ได้มีเจตนาทำขึ้นเพื่อชักชวนมือใหม่มาลงทุนและไม่ถือเป็นคำแนะนำในการลงทุน

📮💕 LET’S CONNECT!

SUBSCRIBE to my channel

https://www.youtube.com/c/GeeMoneyMore

Instagram

https://www.instagram.com/i_amboonggee/

Facebook

https://www.facebook.com/Geemoneyandm…

🎶 Music:

↳ Lakey Inspired: https://soundcloud.com/lakeyinspired/

Disclaimer: Although I am a Financial Advisor by profession, I am not your advisor and no client relationship is established with you in any way. This video, and the ideas presented in it, are for entertainment purposes only and should not be construed as financial adviceคลิปนี้จะมาแนะนำสินทรัพย์การลงทุนสุดคลาสสิค นั่นก็คือ กองทุน VS Index Fund VS ETFs

ซึ่งเป็นสินทรัพย์ในการลงทุนที่ได้รับความนิยมไม่น้อยไปกว่าหุ้นเลย และยังเป็นเครื่องมือในการการจายความเสี่ยงและอื่นๆอีกมากมาย แต่จะรู้ได้อย่างไรว่าแบบไหนเหมาะกับเรา มาดูกัน

Remark! คลิปนี้ไม่ได้มีเจตนาทำขึ้นเพื่อชักชวนมือใหม่มาลงทุนและไม่ถือเป็นคำแนะนำในการลงทุน

📮💕 LET’S CONNECT!

SUBSCRIBE to my channel

https://www.youtube.com/c/GeeMoneyMore

Instagram

https://www.instagram.com/i_amboonggee/

Facebook

https://www.facebook.com/Geemoneyandm…

🎶 Music:

↳ Lakey Inspired: https://soundcloud.com/lakeyinspired/

Disclaimer: Although I am a Financial Advisor by profession, I am not your advisor and no client relationship is established with you in any way. This video, and the ideas presented in it, are for entertainment purposes only and should not be construed as financial advice

Best Vanguard Index Funds \u0026 ETFs For 2021 (Easiest Way To Invest)

🔥Support My Can \u0026 Gain Total Access To All My Financial Decisions, Option Plays \u0026 Private Discord Chat! https://www.patreon.com/bradfinn 🔥

🙋🏻♂️🤷🏻♂️ Curious About Bitcoin: Get $10 of it FOR FREE! https://www.coinbase.com/join/finn_jj

👉🏻TRY THIS FREE DIVIDEND TRACKER! https://trackyourdividends.com/bradfinn/

✅INVESTING APPS I USE(Don’t Put Your Eggs In One Basket)

🔥🔥Robinhood: https://robinhood.c3me6x.net/5R70o

👉🏻👉🏻M1 Finance: https://m1finance.8bxp97.net/eLDV6

👍🏻👍🏻Webull: https://act.webull.com/kolus/share.html?hl=en\u0026inviteCode=1Zb4lR9lVaJJ

🕺🏻The Easiest Way To Invest If You Know Nothing!! Invest Your Spare Change From Debit Card Purchases Using Acorns: https://www.pubtrack.co/9QF2KNC/4WNR4Z/

👇🏻 The Books I Recommend

👇🏻The Gear I Use For The Channel And Podcast

👇🏻Cool Things I Have Round The House

https://www.amazon.com/shop/bradfinn

🙋🏻♂️Know Your Credit Score!! https://creditkarma.myi4.net/rV4e3

🧐Get A Credit Card With NO CREDIT HISTORY: http://jaspercard.com/i/sfdat

😮This FREE APP Tracks All My Financing And Investing in ONE PLACE.

👏🏻 Personal Capital! https://share.personalcapital.com/x/yxRaNj

👉🏻💥CONNECT WITH ME:

🎥Ask Me a Question With A Video Response: heyhe.ro/bradfinn

📞Give Me A Call To Talk Money or YouTube: https://clarity.fm/bradfinn

💻 Email: [email protected]

🍺BEER MONEY DONATIONS🍺

Venmo: https://venmo.com/TheFinnMindset

PAYPAL: https://paypal.me/bradfinn322?locale.x=en_US

Best Vanguard Index Funds For 2021 (Easiest Way To Invest)

Index funds are the best investment path for most people. Its passive approach, low fees, and instant diversification make it very hard to beat. I found myself as a beginner looking to Index Funds to help me get my feet wet and still use them as the backbone of my portfolio today.

In this video I will go through exactly what an index fund is for people that may be new to them as well as some of the most popular Vanguard Index Funds and ETFs.

The first fund we will look at The Vanguard Total Stock Market Index Fund. This is a Passively Managed Index Fund that tracks the progress of the total stock market. This is the perfect beginner investment. It gives you exposure to all the stocks inside the stock market which also gives you massive diversification, not only in the United States, but abroad as well through companies indirect exposure. It does come with a minimum investment and will have associated fees if purchased ousted the vanguard platform. To avoid this you will want to look into its identical EFT which is VTI.

Now if you’re looking to be a little bit more on the safer side a little less volatility because you’re getting a little bit older you might want to have something like Vanguard’s Total Bond Market Index fund it has expense ratio of 0.05 percent. It has a minimum investment of three thousand dollars and it invests in US investment grade bonds. About thirty percent of those being corporate bonds and seventy percent of those being US governmental bonds. A question I get all the time is how much of the the total stock market fund and the bond fund is how much should I have, percentage wise, in my portfolio. It is really up to you. At my age, I don’t have anything in bonds right now, but if you weren’t sure there is something called the Vanguard Balanced Index fund (VBIAX). It does not have

an ETF, but what it does is it is have a blend of stocks and bonds. Right now it has about 60%

inside stocks and 40% in bonds. If you are looking for the ETF for the Bond index it is BND.

Lastly, Is the Vanguard Growth Index Fund (VIGAX). What it does is it track companies that are

more likely to grow more quickly right now and in the near future. That’s pretty much the technology

sector. It has an ER of .05% and it has an investment minimum of $3,000. Its ETF is VUG.

This an a few others are talked about inside this video

DISCLAIMER: The content discussed in these videos are solely my opinion and should never be used as financial advice. This channel is for entertainment purposes only. Make sure to consult with a professional before making money decisions. This video and description contain affiliate links, which means that if you click on one of the product links, I’ll receive a small commission; all of which helps grow the channel! Thank you for your support!

Vì sao nên đầu tư chứng chỉ quỹ? | [Vlog]

Xem thành tích các Quỹ: https://bit.ly/2WKgqjX

Chứng chỉ quỹ đang là hạng mục sản phẩm được quan tâm rất nhiều trong bối cảnh hiện tại. Vậy vì sao nên quan tâm đến hạng mục đầu tư này? Nếu đầu tư, cơ hội sinh lời có thể là bao nhiêu?

Nếu thấy yêu thích nội dung của kênh, hãy bấm like video, share và subscribe TQKS bạn nhé ;). Xin cảm ơn các bạn!

thequockhanhshow tqks chungchiquy dautu sinhloi taichinhcanhan

Subscribe kênh The Quoc Khanh Show:

http://bit.ly/subscribeTQKS

The Quoc Khanh Show

7:00 PM on Tuesday, Thursday and Friday

Produced by KAT MEDIA

Email contact for production: [email protected]

Website: https://thequockhanhshow.com/

Youtube: http://youtube.com/thequockhanhshow

Fanpage: https://facebook.com/thequockhanhshow

Apple Podcast: https://podcasts.apple.com/vn/podcast/thequockhanhshow/id1419543831

Spotify: https://goo.gl/9fSpm8

Waves: https://app.waves8.com/player/show/thequockhanhshowgjfadkebwr

vietsuccess

![Vì sao nên đầu tư chứng chỉ quỹ? | [Vlog]](https://i.ytimg.com/vi/n0uTmU4s_r0/maxresdefault.jpg)

Hướng Dẫn 5 Bước Đầu Tư Tích Sản Hàng Tháng Vào Quỹ ETF

Hướng dẫn 5 Bước đầu tư tích sản hàng tháng vào quỹ ETF

00:00 Mở đầu

02:40 Hướng dẫn 5 bước đầu tư tích sản hằng tháng vào quỹ ETF

03:44 Bước 1: Đầu tư tích sản Dành cho ai?

06:23 Bước 2: Hiểu Quỹ ETF là gì?

Các link tài liệu đính kèm trong livestream:

Cổ phiếu ROS vào VN30: https://bnews.vn/cophieurosduocvaovn30/51449.html

ROS vào quỹ ETF, thị trường sẽ bị ảnh hưởng? : http://thoibaotaichinhvietnam.vn/pages/chungkhoan/20170611/rosvaoquyetfthitruongsebianhhuong44334.aspx

Ví dụ Tracking Error của Dragon FUEVFVND: http://www.fpts.com.vn/FileStore2/File/2021/06/11/20210611_20210611__FUEVFVND__Tracking_error_tu_04_06_den_10_06_2021.pdf

21:10 Bước 3: Bốn tiêu chí chọn quỹ

Kiến thức chung về Quỹ ETF:

1) Các loại quỹ ETF nào niêm yết trên sàn chứng khoán?

http://priceonline.hsc.com.vn/ (tab ETF)

2) Video Talkshow PTC Những điều NĐT cần biết khi đầu tư quỹ ETF: https://youtu.be/DCURWbn0hTo

32:04 Bước 4: Tài liệu Quỹ:

1) TCBS

https://www.tcbs.com.vn/campaign/ifund/quycophieutcef?pk_vid=f8781b1ea3ef75071632464088c84266

Biểu phí giao dịch: https://www.tcbs.com.vn/vi_VN/hotro/chitiet?chuyenmuc=7\u0026url=bieuphigiaodichquydautu

2) Dragon Capital

https://dragoncapital.com.vn/quyhoandoidanhmucetfvfmvn30/etfdanhmucdautu/

3) SSI ETF

https://www.ssi.com.vn/ssiam/thongtinchungssiamvn30

33:19 Bước 5 : Cách mua và thực hiện

Mua như Chứng khoán

Mua định kỳ của TCEF

So sánh kết quả

43:53 Hỏi đáp cùng Cú Thông Thái

🔻Theo dõi Cú Thông Thái để nhập những thông tin hữu ích về chứng khoán. Nếu có bất kỳ câu hỏi nào về trường chứng khoán, Comment Cú sẽ giải đáp cho bạn.

CUTHONGTHAI chungkhoan VNInvestor

| Facebook: https://m.me/CuThongThai.VNInvestor

| Youtube: https://www.youtube.com/channel/UCsk1Sln_4ju2JVyPhFcWwtA

| Tiktok: https://vt.tiktok.com/ZSJJKgbU4/

| Instagram: https://www.instagram.com/cuthongthai/

| Podcast: https://open.spotify.com/show/2QVMe6zi7toZM1YzRdUt7V

| Group cộng đồng Nhà đầu tư F0: https://www.facebook.com/groups/176094777389693

| Link chi tiết về các khóa học: https://www.cuthongthai.net/khoahocf0

| Link mở tài khoản ở Tradingview để phân tích kỹ thuật: https://vn.tradingview.com/?offer_id=10\u0026aff_id=27109

| Link open Crypto account at Binance để giảm 10% phí giao dịch: https://www.binance.com/vi/register?ref=TUOEO2UY

| Link mở chứng khoán tài khoản tại TCBS để hưởng ưu đãi giao dịch:

https://iwp.tcbs.com.vn/105C912839

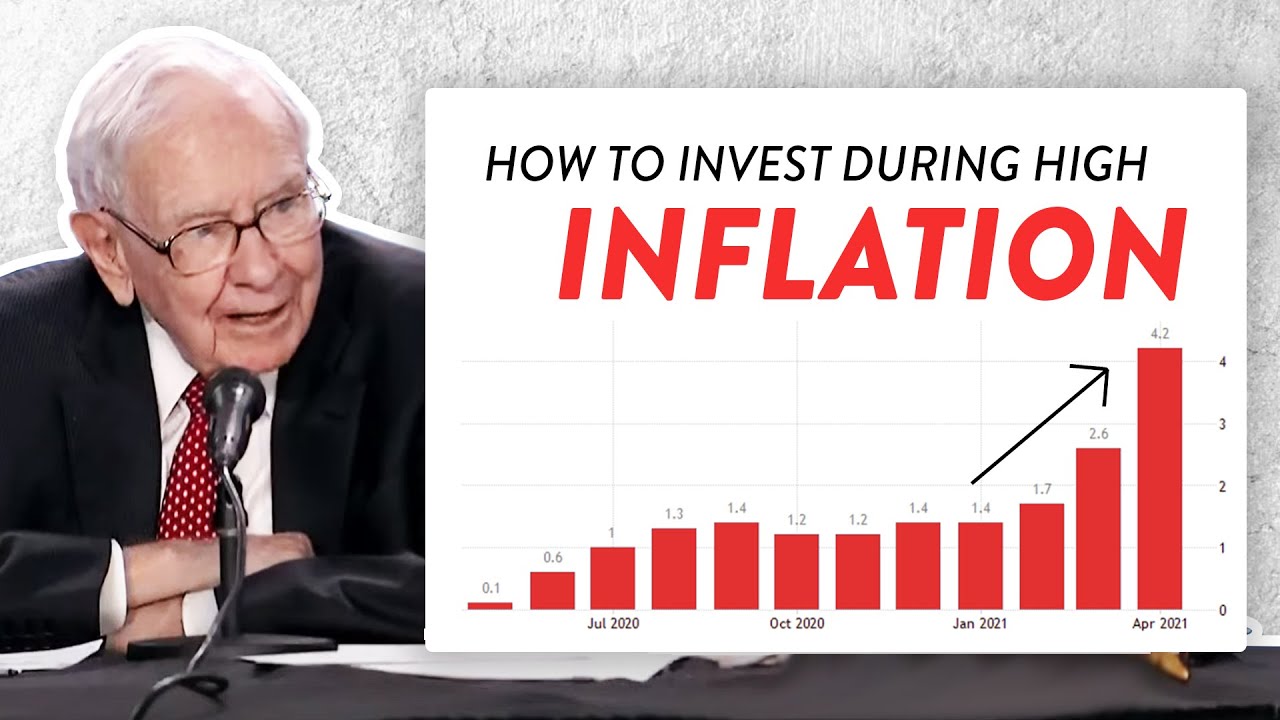

Warren Buffett Explains How To Invest During High Inflation

Inflation has been rising recently, and Warren Buffett has been seeing it happen within Berkshire Hathaway. Today, we analyse some of Buffett’s old shareholder letters, to examine how Buffett thinks about investing during inflationary times.

Check out Stake today, and use this referral link to get a free stock when you fund you account!

https://hellostake.pxf.io/newmoney

★ ★ PROFITFUL ★ ★

Learn to Invest with Brandon van der Kolk (BUNDLE OFFER) ► http://bit.ly/learntoinvestbundle

Learn to Master Your Tax Return (SPECIAL OFFER) ► https://bit.ly/3127TdE

Join the FREE Profitful Investing Community ► http://bit.ly/3bfppQb

Business enquiries: [email protected]

warrenbuffett inflation

นอกจากการดูหัวข้อนี้แล้ว คุณยังสามารถเข้าถึงบทวิจารณ์ดีๆ อื่นๆ อีกมากมายได้ที่นี่: ดูวิธีอื่นๆWiki