NỘI DUNG BÀI VIẾT

Why Emerging Markets ETFs are a Bad Idea

นอกจากการดูบทความนี้แล้ว คุณยังสามารถดูข้อมูลที่เป็นประโยชน์อื่นๆ อีกมากมายที่เราให้ไว้ที่นี่: ดูความรู้เพิ่มเติมที่นี่

https://www.investasian.com/2017/05/14/emergingmarketetf/

Reid Kirchenbauer is the Founder of InvestAsian. He is among the world’s foremost experts on frontier market investment and buying property in Asia.

InvestAsian has local experts on the ground who are always searching, networking, and helping our clients find opportunities they never could otherwise.

https://nomadcapitalist.com/

Andrew Henderson and the Nomad Capitalist team are the world’s most soughtafter experts on legal offshore tax strategies, investment immigration, and global citizenship. We work exclusively with seven and eightfigure entrepreneurs and investors who want to \”go where they’re treated best\”.

Work with Andrew: https://nomadcapitalist.com/apply/

Andrew has started offshore companies, opened dozens of offshore bank accounts, obtained multiple second passports, and purchased real estate on four continents. He has spent the last 12 years studying and personally implementing the Nomad Capitalist lifestyle.

Our growing team of researchers, strategies, and implementers add to our evergrowing knowledge base of the best options available. In addition, we’ve spent years studying the behavior of hundreds of clients in order to help people get the results they want faster and with less effort.

About Andrew: https://nomadcapitalist.com/about/

Our Website: http://www.nomadcapitalist.com

Subscribe: https://www.youtube.com/subscription_center?add_user=nomadcapitalist

Buy Andrew’s Book: https://amzn.to/2QKQqR0

DISCLAIMER: The information in this video should not be considered tax, financial, investment, or any kind of professional advice. Only a professional diagnosis of your specific situation can determine which strategies are appropriate for your needs. Nomad Capitalist can and does not provide advice unless/until engaged by you.

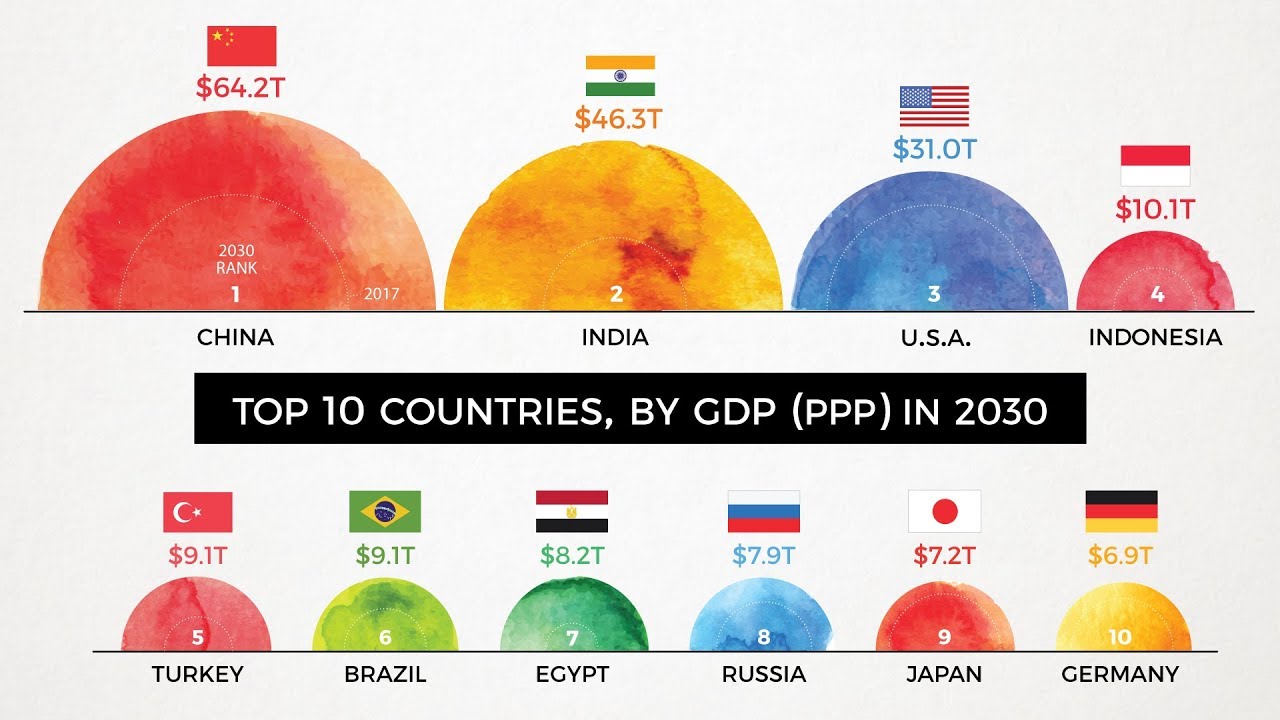

The World’s Largest 10 Economies in 2030

According to projections by a prominent multinational bank, 7 of the world’s 10 largest economies will be in emerging markets by 2030.

Ranking by GDP in 2030 (PPP):

1. China ($64.2 trillion)

2. India ($46.3 trillion)

3. United States ($31.0 trillion)

4. Indonesia ($10.1 trillion)

5. Turkey ($9.1 trillion)

6. Brazil ($8.6 trillion)

7. Egypt ($8.2 trillion)

8. Russia ($7.9 trillion)

9. Japan ($7.2 trillion)

10. Germany ($6.9 trillion)

Source: Standard Chartered Bank

Additional note:

GDP (PPP) uses international dollars adjusted for purchasing power parity. This is a standard practice by economists, and contrasts to GDP (nominal), in which everything is in USD, but not adjusted for relative costs.

Also: reposted as there were some flicker issues on the first upload.

For free daily emails with our infographics and videos, go to https://www.visualcapitalist.com/subscribe

Top 10 Big Emerging Markets in the world 2020

Hello friends. Welcome to explorer diary.

In this video we will see the list of top 10 big emerging markets for next decade.

In today’s global economy, investors are looking more and more toward investment opportunities in emergingmarket nations around the world in order to grow their portfolios.

An emerging market is a country that is recognized as having a significant GDP growth and industrialization, an increase in the size of the middle class.

The rankings of emerging markets take into account not only GDP figures but also look at funding availability and workforce growth.

We will now see the list of 10 Big Emerging Market economies of the world in 2020.

Number 10 in the list is South Africa.

South Africa is the 10th fastest emerging market economy on the list. It is the only African country on the list. South Africa’s advanced economy and strategic location at the tip of the continent makes it a gateway for investors looking to venture into Africa. It is also ranked among the world’s largest emerging economies, which include China, India, Brazil and Russia.

Number 9 is Poland.

Europe’s only entry in the top 10 emerging markets is Poland. The country has been in a remarkable growth cycle since its admittance to the European Union. Given its sizable population and growing middle class, Poland is becoming a growing market of interest to international businesses.

Number 8 in the list is Chile.

South America’s only entry on the list is Chile. As the first South American country to join the Organisation for Economic Cooperation and Development, Chile is one to the fastest growing Latin American economies. The country is a mining giant and the world’s secondlargest producer of lithium.

Number 7 is Thailand.

Thailand is one of the world’s fastest growing emerging markets. It is a growing southeast Asian nation with nominal percapita GDP a bit below China and Malaysia, but well above most others in the region including Vietnam, Indonesia, and the Philippines. They have moderate growth and a diverse economy that flourishes on tourism and exports.

Number 6 in the list is Turkey.

Located at the crossroads between Europe and Asia, Turkey is one of the fastestgrowing economies in the world thanks to its youthful demographic profile. With a burgeoning market of young customers eager to buy goods and services, there is huge potential in Turkey for key sectors such as banking, telecoms, autos, consumer durables and construction.

Number 5 is Malaysia.

Previously restricted to being a major exporter of agricultural goods and commodities, the Malaysian economy is another South East Asian power on the rise. Excellent infrastructure, transport connectivity and a healthy financial sector makes Malaysia a key market for many exporters.

Number 4 is China.

Perhaps a surprise at, number four is China. China has been the dominant theme in emerging markets for 20 years. The country’s rapid transition away from being an emerging market means its GDP growth is expected to slow in the next decade, while its debt levels remain high.

Number 3 is Indonesia.

Comprised of thousands of islands in the Pacific, Indonesia, Southeast Asia’s largest economy contains a number of characteristics that put the country in a great position for newly advanced economic development. Blessed with plentiful natural resources and increasingly less reliant on foreign funding, Indonesia looks set to be a key player in the future with high growth rate.

Number 2 is Philippines.

The Philippines, much like Indonesia, is a large island group with huge economic potential. The Philippines is set to have the highest increase in its labour force of any of the top 10 which, alongside its GDP growth, means it will be one of the world’s fastest growing economies sooner rather than later.

Number 1 in the list is India.

India tops the charts with its massive GDP growth, and it’s likely to be the world’s largest economy one day not just within emerging markets. The country has a huge population and when fully utilized it will be an unshakeable force across global markets.

Emerging Markets Resurgence

There’s a saying on Wall Street that the market can remain irrational longer than you can remain solvent. And there’s a widely held financial theory called \”Reversion to the Mean\” that asserts that eventually asset classes will return to their long term average in terms of several factors including price, price/earnings multiples, and their performance relative to other asset classes like U.S. stocks.

Reversion to the mean for emerging markets stocks has been a long time coming.

This week’s guest, Michael Kass who runs Baron Emerging Markets Fund believes their time has come after a very long cycle of underperformance.

Kass will make the case for an emerging markets resurgence, especially stocks in the two largest markets, China and India.

emergingmarkets china india

00:00 Hello

00:50 Introduction

02:11 Interview with Michael Kass

22:42 One Investment

24:46 Action Point

WEALTHTRACK 1818 broadcast on October 29, 2021

More Info: https://wealthtrack.com/newworldorderofmarketleadership/

The Rise of Emerging Market Multinationals

The Rise of Emerging Market Multinationals demonstrate tremendous growth on par with their economies and increasingly compete with established multinationals on the global stage. The number of EMNCs on the Global 500 list has tripled.

Learn more about EMNCs and the EMR 2018 at the upcoming 2018 Annual hashtagCornellEMI Conference at Cornell Tech on November 9.

Register at bit.ly/CORNELLEMI2018 and repost to your network.

Music: Summer from Bensound.com

Video produced by Forereach

นอกจากการดูหัวข้อนี้แล้ว คุณยังสามารถเข้าถึงบทวิจารณ์ดีๆ อื่นๆ อีกมากมายได้ที่นี่: ดูวิธีอื่นๆTips

https://stromectolis.com/# stromectol price in india